Get Started

Create your account to connect with your personal investment manager.

Already have an account? Log in.

Our strategy is refreshingly simple and boring. Focus on the guest, experience, reviews, keeping expenses low, automate what we can and build in systems and processes for repetitive, mundane things, like statistics.

"5 start glowing review for Garrett's home. If you stay here , you will not be disappointed. We had a beautiful family vacation here with wonderful amenities, games and fun for everyone. Beautiful location and view, especially at sunset. Garrett 's home is full service communication from a pre arrival phone call to review lodging details and directions to a tour upon arrival. As well as available communication during the stay too. We hope to stay here again in the future!!"

Erin November 2022

Guest, Woodside Wonder

"We were in town for a gathering and had a wonderful and comfortable time. The home was in a quiet, peaceful neighborhood with lovely views and surroundings. Plenty of space for seven guests to share meals, sleep and have privacy, but also enjoy common spaces for board games, movies, and conversation. Check-in was smooth. Check out was incredibly quick and easy. Garrett was responsive when we had questions and needs, so thoughtful and thorough. Would highly recommend and look forward to another stay soon. Thank you!"

Melissa October 2022

Guest, Executive Hillside Hideaway

Can this property fetch at least $200 bucks a night? If so, we’re on it like hotcakes. Q1 2022, we’re trending at $300+.

We prioritize staying sub the $750k range as to protect against downside risk. With some outliers of course.

During underwriting, the property must produce at least 10% CoC and maintain an upward projection.

It should hit at least 20% ROI as an average over the first 5 years (cash + equity + tax benefits). Typically, by year 3.

We avoid markets with 50% or more swings of seasonality. A little bit of seasonality is normal.

It’s what you keep. Not what you make. Live anywhere but invest where it makes sense.

Us. Lender. Property Management. Us Again. Lender Again. 5 points of failure. Check.

Who wants to pay taxes when you can be smart about it? Our properties see 25-35% write offs.

Yup, more tax savings. We want tax free cash flow after all. So, we look for those opportunities.

Can we list this type of property across multiple channels? We want this to be yes.

Markets near national parks, destinations and/or outdoorsy tend to outperform.

We underwrite as an STR, MTR and LTR just in the event we need to quickly adapt.

Business goers, travelers, adventure seekers galore. All are welcome.

This one is a must. At least in that major jurisdiction to avoid costly buy and sells.

Can this property perform “Ok” in the event of lower than expected OCC? Sub 50%.

How can we make this “pop” off the screen? Guests take 7 minutes before picking a spot.

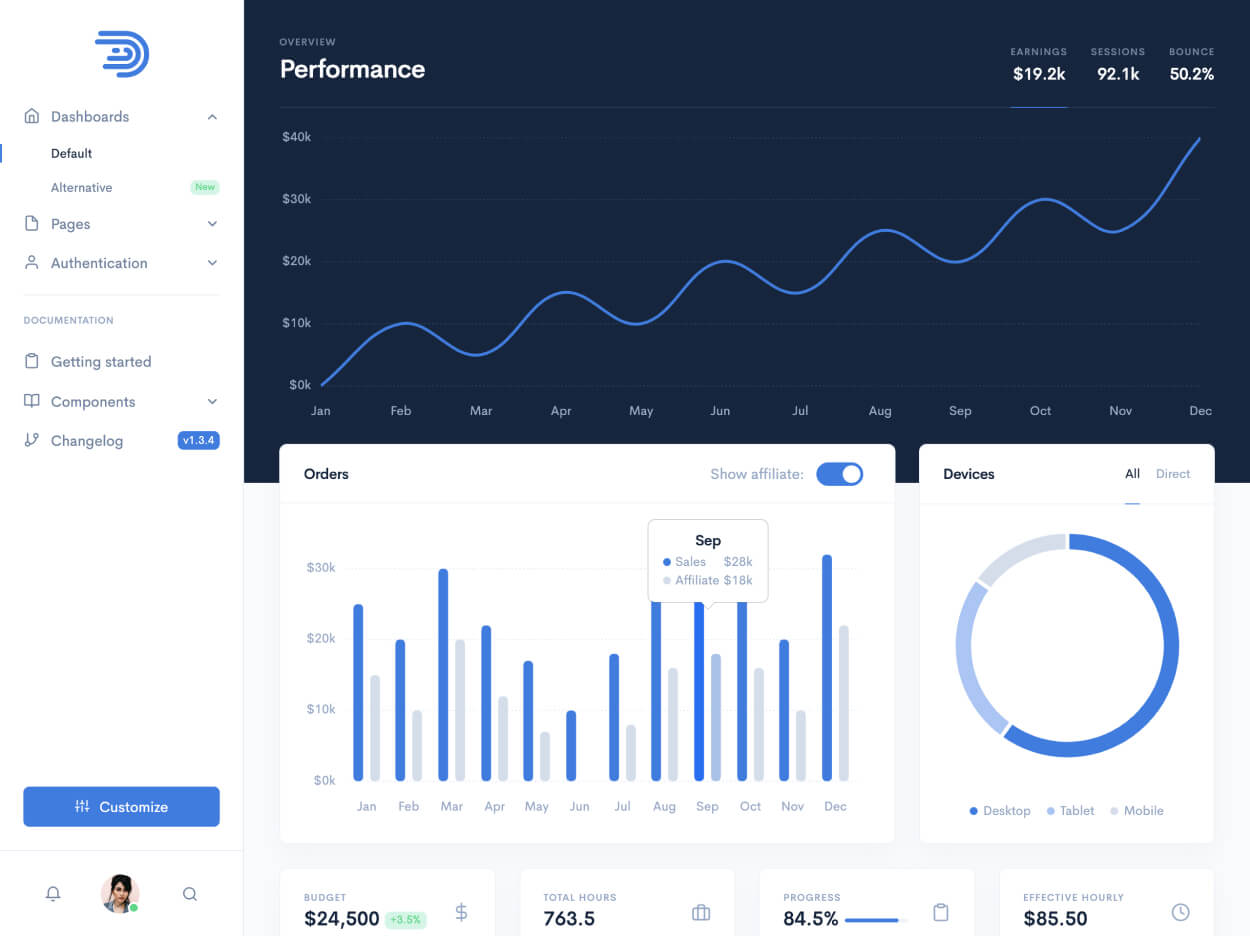

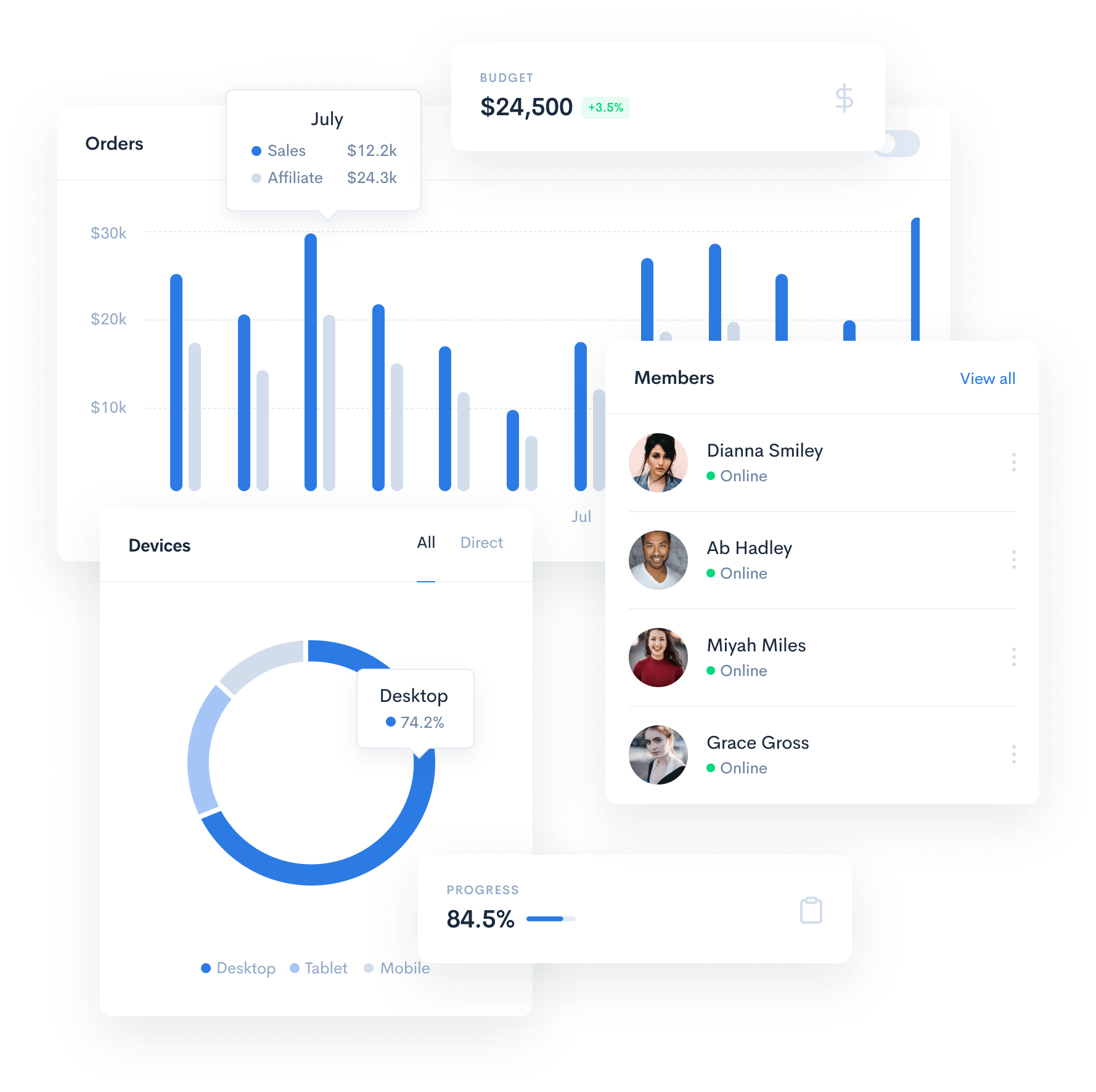

We sift through every piece of data we collect to maximize returns and remarket our clients value added services, including using AI to spot and optimize additional revenue and growth opportunities.

Serivces

Satisfaction

Review Score

We aim to take care of both our customers and investors. Quality and impeccable service is paramount to our strategy. We'll always be there to lend a helping hand.

Efficiency

Teamwork

5-Star Reviews

Stewardship

Lower costs to operate because of economies of scale + tech

Higher profits with functional design + automation